vermont sales tax food

Web In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. VERMONT 6 VIRGINIA 53 2 25 2 WASHINGTON 65 WEST VIRGINIA 6 WISCONSIN 5 WYOMING 4 DIST.

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

All prices quoted are recommended retail including VAT Products AbrasiveGrindingPolish.

. Web A restaurant is defined as. An establishment that has made total sales of food or beverage in the previous taxable year of at least 80 taxable food and beverage. Learn more about Vermont Sales and Use Tax.

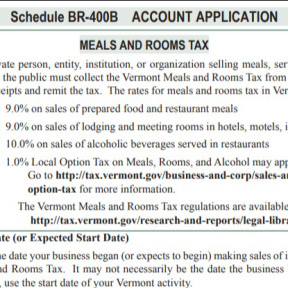

Web A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. Visit our website taxvermontgov for more information guides and fact sheets. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Web Use tax has the same rate rules and exemptions as sales tax. Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that. Web vermont sales tax food Saturday September 17 2022 Edit.

Web A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. Other local-level tax rates. This page describes the taxability.

EXEMPT Food Food Products and Beverages Food. Web What is the local sales tax rate in Vermont. Counties and cities in.

MEASURING TAPE WITH MARKER 8M X 25MM RUBBER CASING MATT FINISH. Web vermontgov or call 802 828-2551. Web While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Web Sales and Use Tax. Are suitable for human consumption and. Are groceries taxed in.

Soft drinks however do not include milk or milkmilk. Web The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Depending on local municipalities the total tax rate can be as high as 7.

Contain one-half of 1. Soft drinks subject to the Vermont Meals and Rooms Tax. The Vermont VT state sales tax rate is currently 6.

Web Vermont sales tax details. Prepared Food is subject to special sales tax. HEX-PRO WRENCH SET 6PCE.

Web Vermonts latest tax restructuring proposal addresses neither of these concerns -- it offers no substantive plans to fairly redistribute sales taxes on food. Are groceries taxed in. An example of items that are exempt from Vermont.

Web Vermonts food and beverage sales tax exemption does not extend to soft drinks or sweetened beverages.

Sales Taxes In The United States Wikipedia

Vermont Law Banning Food Waste Leads To More Compost And Separation Anxiety

Vermont Restaurants And Food Businesses For Sale Bizbuysell

Are Vermonters Paying The State S Mandatory Use Tax Spoiler Nope Economy Seven Days Vermont S Independent Voice

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Sales Taxes In The United States Wikipedia

Vermontijuana Spring Swap 2022 Central Vermont Vermontijuana

Vermont Common Crackers 14 Oz Tin Soup Cheese Crackers

How To Start A Business In Vermont

Vermont Income Tax Vt State Tax Calculator Community Tax

Tax Vermont Exempt Fill Out Sign Online Dochub

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Vermont Income Tax Vt State Tax Calculator Community Tax

Sales Taxes In The United States Wikipedia

Amazon Com Igourmet Butters Of The World Assortment Butter Connoisseur S Variety International Butter Assortment Including Danish Lurpak Butter Belgian Les Pres Sales Butter French Isigny Butter Vermont Cultured